BTC Price Prediction: Path to $200,000 Amid Technical Consolidation and Mixed Fundamentals

#BTC

- Technical indicators show BTC testing crucial support at $111,000 with mixed momentum signals

- Market sentiment is balanced between negative fee compression and positive institutional reaffirmation

- Reaching $200,000 requires a 78% increase but remains possible with institutional catalyst adoption

BTC Price Prediction

Technical Analysis: BTC Shows Mixed Signals Near Key Support

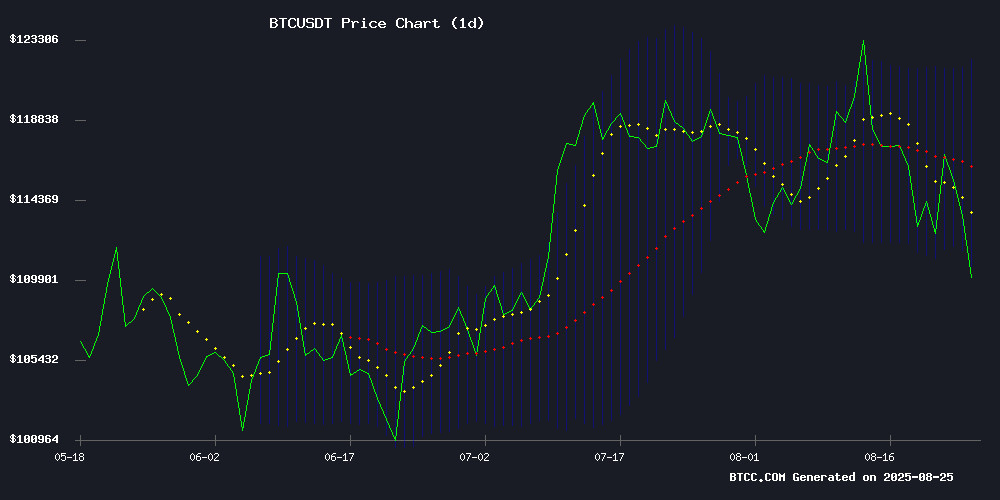

BTC is currently trading at $112,531, below its 20-day moving average of $116,585, indicating short-term bearish pressure. The MACD reading of 1,067.22 remains positive but shows weakening momentum with the signal line at 35.15. Bollinger Bands suggest consolidation between $121,897 (upper) and $111,274 (lower), with the current price hovering NEAR the lower band support level.

According to BTCC financial analyst Emma, 'The technical picture suggests BTC is testing crucial support around $111,000. A break below could see further downside toward $105,000, while holding above may trigger a rebound toward the middle Bollinger Band around $116,585.'

Market Sentiment: Mixed Fundamentals Amid Fee Compression and Institutional Interest

Current news flow presents a complex landscape for Bitcoin. Negative factors include decade-low transaction fees indicating reduced network activity, profit-taking pressure, and mining companies like Hut 8 shifting focus from Bitcoin to AI. However, positive developments include VanEck maintaining its $180,000 price target, growing CME basis rates suggesting institutional demand, and potential altseason rotation that could eventually benefit BTC.

BTCC financial analyst Emma notes, 'The fee market compression is concerning for network security, but institutional reaffirmation of bullish targets and index inclusions like Metaplanet's FTSE upgrade show underlying strength. Market sentiment appears cautiously optimistic despite short-term headwinds.'

Factors Influencing BTC's Price

Metaplanet Upgraded to FTSE Japan Mid-Cap Index, Bolstering Bitcoin-Centric Strategy

Metaplanet's inclusion in the FTSE Japan Index effective September 22 marks a significant milestone for the Bitcoin-focused firm. The MOVE positions the company alongside established Japanese large- and mid-cap equities, potentially unlocking institutional investment through index-tracking ETFs from managers like Vanguard.

The listing automatically qualifies Metaplanet for the FTSE All-World Index, amplifying global visibility. This dual-index exposure could drive passive capital inflows, enhancing liquidity for a stock that's seen shareholder counts explode tenfold since adopting Bitcoin treasury strategies.

Second-quarter results reveal the depth of Metaplanet's bitcoin pivot. Revenue surged 41% to $8.15 million, with 91% derived from BTC put options. The firm aggressively expanded its holdings, adding 878 BTC in August alone to reach 18,991 BTC - part of an ambitious roadmap to accumulate 210,000 BTC by 2027.

Financing this acquisition spree, Metaplanet raised $1.65 billion through stock options year-to-date. The NAV premium continues rising as institutional demand grows for Bitcoin-correlated equities in regulated markets.

Bitcoin Price Attempts Recovery Amid Bearish Pressure

Bitcoin shows tentative signs of recovery after dipping to $110,650, with buyers pushing the price back above $112,200. The rebound faces immediate resistance NEAR $113,600, with a critical bearish trendline capping gains at $114,000.

Market structure remains weak as BTC trades below both the $114,000 level and the 100-hour moving average. A decisive break above $114,500 could signal renewed bullish momentum, while failure to hold $110,650 may trigger another leg down.

Bitcoin Fees Hit Decade Low as Investors Rotate to Altcoins

Bitcoin transaction fees have collapsed to levels not seen since 2011, with Glassnode reporting a 14-day average of just 3.5 BTC. The metric signals evaporating demand for block space as BTC's price momentum stalls.

Paradoxically, active sending addresses surged recently according to CryptoQuant data—a telltale sign of portfolio rebalancing. The timing coincides with altcoins outperforming, suggesting capital rotation toward higher-beta assets.

Exchange outflows complicate the narrative. Despite apparent diversification, investors continue withdrawing BTC from trading platforms. This divergence hints at simultaneous long-term accumulation and short-term profit-taking strategies.

Hut 8 Expands Equity Program to $1B, Shifts Focus from Bitcoin Mining to AI

Hut 8 Mining Corp. has doubled its equity program to $1 billion, signaling a strategic pivot away from Bitcoin mining toward large-scale AI infrastructure projects. The move follows the near-complete utilization of its previous $500 million funding authorization, which raised nearly $300 million before being shelved.

The company broke ground last week on a $2.5 billion AI data center campus in Louisiana's West Feliciana Parish. Spanning 611 acres, the project will feature two 450,000-square-foot computing facilities, with the first phase slated for completion by late 2025. Local officials anticipate thousands of temporary construction jobs and dozens of permanent high-skill positions.

Bitcoin miners face mounting pressures from network difficulty spikes, volatile BTC prices, and constrained energy markets. Hut 8's rebranding as a "power-first, platform-driven business" reflects broader industry trends as mining operators diversify revenue streams beyond cryptocurrency rewards.

Bitcoin Fees Plummet to 2011 Levels as Blockspace Demand Wanes

Bitcoin's transaction fees have collapsed to levels last seen during the Satoshi era, with the 14-day moving average dropping to just 3.5 BTC. Glassnode data reveals this metric hasn't been this low since Bitcoin's early adoption phase in 2011.

The fee decline stems from evaporating demand for blockspace, underscoring Bitcoin's evolution from payment rail to store of value. On-chain activity shows corporations like Strategy accumulating BTC as digital treasury assets rather than transactional tools.

Galaxy Digital analysts note nearly half of recent blocks operate below capacity, with mempools frequently empty. "Miners anticipated fee revenue to compensate for post-halving rewards reduction to 3.125 BTC," observed Galaxy. "Instead, they're facing the opposite scenario."

Bitcoin 30-Day Active Supply Signals Slow Activity—Could BTC Be Preparing For A Big Move?

Bitcoin's price action has been lethargic in recent weeks, failing to sustain momentum despite briefly touching a new all-time high. The cryptocurrency dipped below $112,000 before rebounding slightly after Federal Reserve Chair Jerome Powell's remarks. By August 23, BTC retreated again, hovering near $115,000—a sign of consolidation before its next decisive move.

On-chain analytics firm Alphractal highlights the 30-Day Active Supply metric as a critical indicator. This gauge measures unique coins transacted within a month, reflecting market participation. Historically, spikes in this metric have preceded major price reversals, suggesting accumulating investor activity may foreshadow BTC's next directional shift.

Decentralized Exchanges Gain Ground in Perpetual Futures Market

Decentralized exchanges (DEXs) are making significant inroads into the perpetual futures market, long dominated by centralized platforms like Binance and Bybit. The shift marks a pivotal moment in 2025 as PerpDEXs overcome technical hurdles to deliver CEX-like trading experiences onchain.

Perpetual futures, accounting for over 90% of crypto derivatives volume, have been the crown jewel of centralized exchanges. But a new wave of DEXs is challenging that dominance by combining deep liquidity with intent-based architecture and improved user interfaces.

The migration mirrors DeFi's earlier disruption of spot trading, with DEXs now offering superior privacy, access, and non-custodial security for Leveraged trading. While technical limitations previously slowed adoption, 2025 has seen these barriers fall as decentralized platforms mature.

Bitcoin's Fee Market Crisis Threatens Network Security

Bitcoin's economic model faces mounting pressure as transaction fees plummet to near-zero levels. The network has seen a sharp decline in non-monetary activity since late 2024, with median daily fees dropping over 80% since April 2024. Nearly 15% of blocks now process transactions at minimal cost, creating what analysts call 'free blocks.'

Miners confront a perfect storm—the 2024 halving reduced block subsidies just as fee revenue evaporated. Recent data shows almost half of blocks don't reach maximum weight, revealing unprecedented slack in blockspace demand. The collapse follows the boom-and-bust cycle of OP_RETURN transactions, which once comprised 40-60% of network activity during the Runes protocol frenzy.

Galaxy Digital's warning cuts to the core: a settlement LAYER needs settlements. Without sustainable fee pressure, Bitcoin's security budget hangs in precarious balance. The market now watches whether organic demand can fill the void left by speculative ephemera.

VanEck Reaffirms $180K Bitcoin Target Amid Surging CME Basis Rates

Investment firm VanEck has doubled down on its $180,000 year-end Bitcoin price forecast despite recent market turbulence. The conviction comes as CME basis funding rates spike to 9%, a level not seen since February 2025's market peak. Bitcoin's price action reflects this institutional confidence—after dipping to $112,000 in early August, it reclaimed $124,000 on August 13, eclipsing July's $123,838 all-time high before settling near $115,000.

Behind the resilience lies voracious institutional accumulation. Exchange-traded products snapped up 54,000 BTC in July while corporate treasuries added 72,000 BTC to their balance sheets. Derivatives markets echo this appetite, with call/put ratios hitting 3.21x—the most lopsided bullish skew since June 2024—as traders deployed $792 million in call option premiums. Notably, compressed 32% implied volatility makes leveraged bullish bets cheaper today than in late 2024, with out-of-the-money calls now priced at just 6% of spot versus 18% historically.

Bitcoin Dominance Tipped To Crash 35% — Major Altseason Ahead?

Prominent market analyst Egrag Crypto predicts a seismic altseason following a critical breakdown in Bitcoin Dominance (BTC.D). The BTC.D weekly chart recently closed below the 21-week Exponential Moving Average, a technical milestone historically preceding steep declines in Bitcoin's market share. Similar patterns in past cycles saw dominance drops of 47.86% and 42%.

The altseason debate has divided analysts, with some dismissing the possibility due to altcoins' elevated trading volumes over four years. Others anticipate selective outperformance based on fundamentals. Egrag's analysis suggests a parabolic rally across altcoins could mirror historical precedents, where shrinking BTC dominance fueled exponential gains in alternative cryptocurrencies.

Bitcoin Demand Cools as Profit-Taking Persists

Bitcoin's rally has entered a cooldown phase as investors continue to take profits and institutional demand wanes. CryptoQuant's latest report shows BTC's apparent demand has dropped to 59,000 BTC—a 66% decline from July's peak of 174,000 BTC.

Institutional buyers, including major player Strategy, have sharply reduced accumulation. Their purchases fell from 171,000 BTC in November 2024 to just 27,000 BTC over the past month. Spot Bitcoin ETFs reflect the trend, with net inflows hitting four-month lows at approximately 11,000 BTC.

On-chain metrics signal weakening momentum, though the broader market structure remains intact. The CryptoQuant Bull Score Index has retreated from earlier highs, suggesting consolidation may persist unless demand rebounds.

Will BTC Price Hit 200000?

Based on current technicals and market fundamentals, reaching $200,000 appears challenging in the immediate term but remains plausible within a 12-18 month horizon. The current price of $112,531 would require approximately a 78% increase from current levels.

| Metric | Current Value | Required for $200K |

|---|---|---|

| Price | $112,531 | +77.8% |

| 20-day MA | $116,585 | +71.5% |

| Bollinger Upper | $121,897 | +64.1% |

BTCC financial analyst Emma suggests: 'While technicals show near-term resistance around $122,000, institutional adoption trends and potential ETF inflows could provide the catalyst for a move toward $200,000. However, this would require breaking through multiple resistance levels and sustained bullish momentum.'